Antifragile Financial Capital: Thriving Amid Uncertainty

Antifragile Financial Capital

How can we ensure that a family’s financial capital is antifragile? Remember, antifragility means that we come out of a shock stronger than we went in. The question is no longer just how to preserve wealth but how to position it to thrive in the face of disruption. We want uncertainty, volatility and black swan events to be our best friends. Alone this first mindset shift will but you on the right road.

Wealth preservation is often touted as the ultimate goal for families. However, what does preservation mean? Preservation strategies usually keep a family’s financial wealth constant in the face of inflation and family expenditure. Have you ever considered that your family tends to grow with each generation? Or how about the growth of the money supply? (where we could consider this the real asset inflation). This might be an Aha moment for you, or you were already aware of this. The financial capital needs to grow, for it to be preserved on a per capita basis of the family.

Before I carry on, I want to stress, that this is not financial advice. What will follow is a though experiment. Before you act any of it out, you should consult your financial advisors. The world of finances is vast and there are many tools and assets out there. Many that will befuddle you.

Back to the topic at hand. How you can position yourself will depend on many factors, for example if there is an operating business. Often, families have most of their capital tied up in that business. Some families have a portfolio of assets instead, and thus more flexibility. Most families have areas of deep expertise, where they can generate extraordinary returns. It makes sense to focus on these areas, but at the same time, it creates a vulnerability. A high concentration will expose you to market crashes, geopolitical shifts, technological disruption and generational transitions.

Moreover, traditional asset allocation strategies—rooted in modern portfolio theory—are designed for institutions, not families. These models assume passive behavior, stable correlations, and liquid markets. Business families, by contrast, must navigate emotional capital, legacy obligations, and the illiquidity of core assets. Thus, they require a fundamentally different approach that goes beyond diversification and embraces asymmetry, adaptability, and optionality.

Fragile vs Antifragile Assets

What makes an investment fragile? It is worth to consider not only the type of investments we want in a portfolio. But also the kind of investments we do not want in a portfolio. After all, famous Investor Charlie Munger liked to say

"Avoiding bad investments is just as important as picking the good ones—discipline is the true secret to success."

and

"Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1."

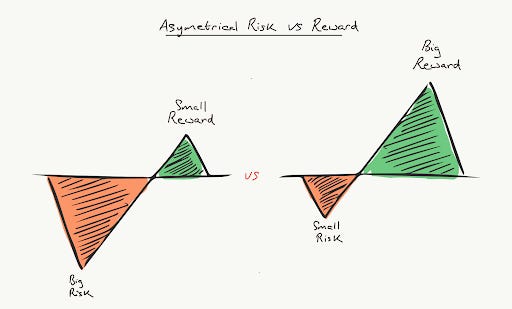

Assymetrical opportunities

If you can manage to avoid the stupid investments and hit a few home runs, you will basically be set. Essentially, you want to try to avoid investments with negative asymmetrical opportunities. Big words, bear with me. Asymmetrical opportunities can be positive or negative. Positive means that the potential upside is much larger than the potential downside. Negative means that the downside is much larger than the upside. Usually, downside protection comes at a cost. However, that is not always the case. For example, a loan is a fragile investment. At its core, you are betting 100% of your allocated capital on something for let’s say a 10% yearly return. Now you can lose the full 100% in exchange for an annual upside of 10%. That is not a positive asymmetry. Yes, you can structure loans differently, adding collateral, adding potential upsides, adding clauses to the contract and legal protections. At its core ,it is still fragile.

An example of a positive asymmetrical opportunity would be an option. Typically, a call option is an investment with limited downside but a lot of upside. Again, there are ways to structure options for them to be negative. There is stuff like CFDs out there or Knock-out certificates. Things where the issuer is sure to win a lot, and you not so much. At the core of it, a call option is still positively correlated, meaning that I pay a small amount for an option I can take or not. So if the scenario I bet for takes place, I can seize the opportunity, but if it does not come about, I am not forced to do anything. I only lose my initial investment in entering the bet.

Incompetence and dishonesty

Fragile assets are also assets where incompetence can reign. Proper Due Diligence on the people behind an investment is essential. Who is in charge and why? Something my family learnt the hard way, and I also had my experiences in this regard. Are the people competent? And do they act with integrity? If incompetence and dishonesty find each other, you are in for a ride. One alone is bad enough. If you are into distressed investing, find the companies where one or both reign and wait for your chance to take it up cheap. Otherwise, stay very far away. Any company or industry where dishonesty and/or incompetence is strong is highly fragile.

Lack of control

When we invest, we usually give away control of our capital and trust the other party to perform. Particularly, with illiquid investments. In liquid markets, we at least have the power of selling our stake at any time, if the markets allow it. This is the main reason families like to invest into their main operating business. It is the illusion of control. Forgetting that the company plays by the same rules as everyone else. However, you can have more or less control and it helps to ensure that you have sufficient power in specific events.

Centralisation

Centralisation in any organisation is a sign of fragility. Be it your family or a company you look into investing in. Centralised decision-making makes for more fragile systems. More fragemented economies perform better in crisis times than highly centralised/concentrated economies. Another great example is the Millennium Challenge 2002, where retired Marine Corps Lieutenant General Paul Van Riper played the role of the opposing force (Team Red a Middle Eastern adversary). By employing a decentralised command structure, he beat the US military (Team Blue) in the wargame. Essentially, the US forces using a centralised command structure were too slow to respond, while Team Red responded quickly and independently.

Lone Wolf

A Lone Wolf mentality makes for fragile investing. Sounds strange, but let me explain. Once we have mastered one area of investing, for example, stock picking, we might believe we can do it all. You will get a bloody nose when you venture into a new industry, say Real Estate. Instead, it is better to find allies in each area you operate in. People with different experiences and different skill sets. Teaming up will not only spread the Risk (more people putting capital into the pot), but the returns will be better. Also, by teaming up, you can allocate less capital to each area and thus be more diversified.

Leverage

Leverage makes for fragile systems. The more debt you onboard, the less margin for error you have. Also, debt is to be used strategically. A typical mistake is to utilise debt to finance luxury, consumption or to buy a house to live in. It is a different story if debt is utilised to grasp opportunities and to improve the returns on your invested capital. Still overleveraging too much will cost you. A recent example is Rene Benko, Austria’s former Real Estate star. He built a house of cards on debt, and the moment the real estate market struggled it all fell apart.

No Cashflow

No Cashflow is another example. If your portfolio does not deliver any cashflow you rely on strategic sales. Again, if the market struggles, you will not be able to sell your assets well, or at all sometimes. A cashflow strong portfolio will get through hard times better and will give you the chance to invest during the crises when assets are cheap.

No redundancies

An overly lean investment structure makes for a fragile portfolio. Redundancies are a waste of resources in good times. However, in hard times, they become important assets. A cash reserve or a strategic credit line for opportunities might seem a waste while the market is great. Once there is a situation at hand, they are lifesavers. Things like Just in time production and lean production have become the hallmark of manufacturing. Just as long as everything runs smoothly. Once things falter, the whole process breaks apart.

Short Term thinking

An overly Short-term investment mindset is poison to a portfolio. An antifragile portfolio is invested for the long term. Successful families think in decades and centuries, not in quarters. However, some short-term bets coupled with long-term investments put you in the position to gain from volatility, while the main investment portfolio is poised to perform in the long term.

No consequences

Has your team and the people you invest in any skin in the game? If there are no consequences for mistakes, then most people will not be reliable. Often, only the upside is incentivised, which is a good start. However, this may lead to reckless decisions. If, for example, you work with a real estate developer and he is not ready to take personal liability for your investment, then I would caution investing.

Principles of Antifragile Investing

Let us sum up briefly what we discussed above from the other perspective and nail down the principles of antifragile investing.

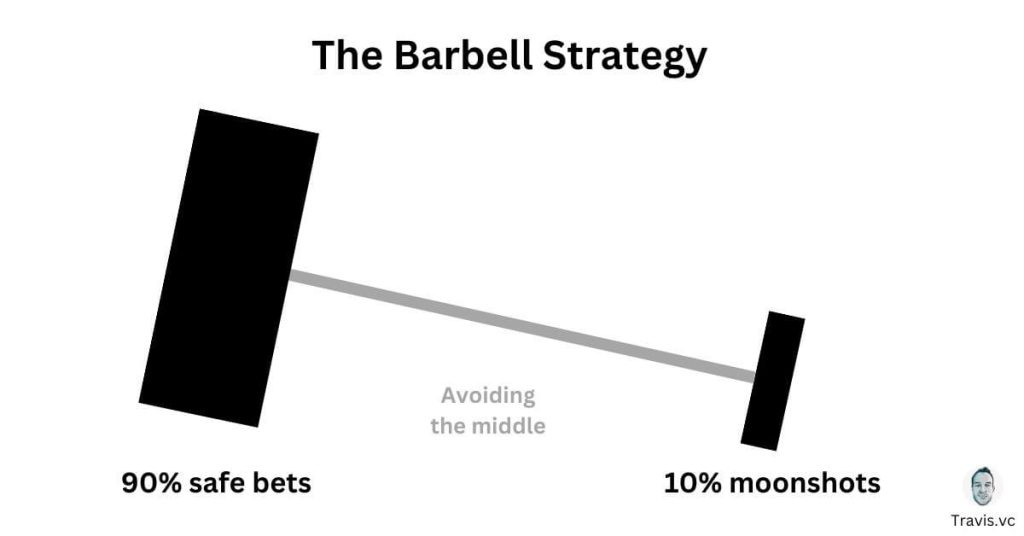

1. Barbell Strategy: One of the core tenets of antifragile investing is the barbell approach—allocating a significant portion of assets to ultra-safe, low-volatility investments (e.g., cash, short-term Treasuries), while placing a smaller portion in high-risk, high-reward opportunities (e.g., venture capital, early-stage tech, emerging markets). This creates a portfolio with limited downside and meaningful upside.

2. Optionality: Business families should seek investments that provide asymmetric payoffs—limited losses with significant upside potential. These include venture capital, intellectual property, and opportunistic real estate. Optionality allows families to benefit from unexpected positive events without needing to predict them.

3. Redundancy and Liquidity Buffers: Redundancy is often seen as inefficient in traditional finance, but for antifragile investors, it's a necessity. Holding excess liquidity may seem unproductive in bull markets, but it provides the dry powder to seize opportunities during downturns.

4. Decentralisation: Avoiding single points of failure is critical. This means decentralising wealth across different jurisdictions, asset classes, and even family branches. It also means empowering different family members or teams to pursue independent strategies, fostering innovation and resilience.

5. Skin in the Game: Ensuring that decision-makers have personal exposure to the outcomes of their decisions aligns incentives and increases prudence. This principle applies to family members managing capital, external managers, and operating partners. People, before the investment, means that proper Due Diligence is done on the people.

6. Team up: Find partners for each asset class. Partners that complement you and where together you can generate outrageous returns.

7. Smart Diversification: Rather than spreading assets thinly across sectors, antifragile diversification focuses on uncorrelated sources of return. This might mean combining real estate with venture capital, gold with frontier markets, or traditional equities with regenerative agriculture.

8. Alternative Assets: Private equity, hedge funds, infrastructure, and collectables can provide exposure to non-linear returns and unique sources of optionality. Business families are well-positioned to access these due to their patient capital and long-term horizons.

9. Dynamic Rebalancing: Traditional portfolio rebalancing assumes mean reversion. Antifragile investing embraces dynamic rebalancing based on emerging risks, opportunities, and the evolving landscape. This means periodically reassessing whether assets still provide optionality or have become fragile.

10. Investing in Knowledge and Adaptation: Allocating resources to education, digital transformation, and R&D isn't just a business strategy—it’s an investment in long-term antifragility. Families that learn faster adapt better.

11. High cashflow and low debt: Rather than chasing high valuations on paper and overloading on debt, look for profitability and cashflow. Use debt strategically.

What is next?

With the antifragile investing principles nailed down, we can go into specifics. This is for the next newsletter. Before next week, take a moment to think about your portfolio and your investment approach. Are you following antifragile steps? Or are you more on the fragile side?